With this purchasing procedure, security on gold shipments was enhanced. Only the purchaser, the U. S. Government, and selected individuals within a steamship company would be aware of their respective shipment obligations, and these details were made available only to individuals on a need-to-know and when-to-know basis. Ultimately, as will be discussed further under "Security," in addition to the owner, only selected steamship company managers, as well as the actual transporting vessel's Master, Purser and/or First Officer, would know the specific ocean-transport details of gold shipments.

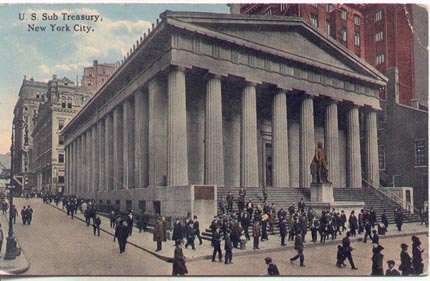

(Postcard circa 1907)

2c. Operations of the Assay Office and Sub-Treasury. Gold export movements, and the lack thereof, were determined by the market price (rate of exchange), availability, and composition of gold for export.  Gold, by virtue of commercial usage and the laws of the various countries of the world, may be said to be the only international money, and its purchasing power is practically the same throughout the world. But, bear in mind, the value of gold coins is not always as expressed on their face. In large international transactions the weight of the mass is regarded and not the number of pieces, and their value depends upon the weight and fineness. By fineness is meant pure metal. Nearly all coins contain alloy or inferior metal which is added to increase their durability. Gold, by virtue of commercial usage and the laws of the various countries of the world, may be said to be the only international money, and its purchasing power is practically the same throughout the world. But, bear in mind, the value of gold coins is not always as expressed on their face. In large international transactions the weight of the mass is regarded and not the number of pieces, and their value depends upon the weight and fineness. By fineness is meant pure metal. Nearly all coins contain alloy or inferior metal which is added to increase their durability.

The value or price of the gold money of account of commercial countries is determined by the weight and fineness of the metal contained therein, which weight and fineness are established by the mint laws of the country issuing the money. It is therefore essential that the standard of weight by which the various moneys of account are established shall be unvarying, and have the highest legal sanction; otherwise there could be no stability of values and no such thing as accurate deductions of pars of exchange. Gold is the only commodity in the world, the value of which is established by law. The value or price of the gold money of account of commercial countries is determined by the weight and fineness of the metal contained therein, which weight and fineness are established by the mint laws of the country issuing the money. It is therefore essential that the standard of weight by which the various moneys of account are established shall be unvarying, and have the highest legal sanction; otherwise there could be no stability of values and no such thing as accurate deductions of pars of exchange. Gold is the only commodity in the world, the value of which is established by law.

Foreign Exchange, An Elementary Treatise Designed

for the Use of the Banker, the Businessman and the Student

The Financier Company, New York, 1902, Pg 156.  The Assay Office is a branch of the United States Mint, and, as its name indicates, it receives and assays deposits of gold and silver and returns same to the depositors in the shape of bars, or the Government will give coin for the value of the gold. An interesting book could be written about the Assay Office, its methods of melting and refining, and its marvelous scales, which are so delicately adjusted that they can weigh one-half of one hair of a person's head. It is from this office that the exporters of gold obtain most of the yellow metal for shipment; and it is in this connection that the Assay Office becomes an important part of the mechanism of Wall Street. In this office we are confronted with the evidence of the dual character of gold as money or a medium of exchange, and as merchandise, an article itself bought and sold the same as pig-iron. The Assay Office makes two kinds of gold bars for sale: small bars varying in value from $100 to $700, which are bought for use in the arts and sciences; and large bars varying in value from $5,000 to $8,000, which are used for the export of the precious metal. These bars are stamped with weight and fineness as ascertained by the assay. Exporters pay 4 cents per $100 for them, but even at this cost the bars are cheaper than coin would be. The Assay Office is a branch of the United States Mint, and, as its name indicates, it receives and assays deposits of gold and silver and returns same to the depositors in the shape of bars, or the Government will give coin for the value of the gold. An interesting book could be written about the Assay Office, its methods of melting and refining, and its marvelous scales, which are so delicately adjusted that they can weigh one-half of one hair of a person's head. It is from this office that the exporters of gold obtain most of the yellow metal for shipment; and it is in this connection that the Assay Office becomes an important part of the mechanism of Wall Street. In this office we are confronted with the evidence of the dual character of gold as money or a medium of exchange, and as merchandise, an article itself bought and sold the same as pig-iron. The Assay Office makes two kinds of gold bars for sale: small bars varying in value from $100 to $700, which are bought for use in the arts and sciences; and large bars varying in value from $5,000 to $8,000, which are used for the export of the precious metal. These bars are stamped with weight and fineness as ascertained by the assay. Exporters pay 4 cents per $100 for them, but even at this cost the bars are cheaper than coin would be.

The coin can be obtained without premium at the Sub-treasury on presentation of legal tenders, but coin is inferior to bars for export, because more easily abrased. The stamp of the United States on a coin is effective only within our own boundaries. As soon as the coin reaches a foreign country, its value is determined not by the stamp upon it but by its weight. So, when we are compelled to pay our debts by a gold shipment, the gold, whether it be bars or coin, is weighed and its value ascertained. Coin loses value by handling. Even new coin carried in bags loses value by abrasion during the trip across the Atlantic. It is stated at the Assay Office that if a bag of gold coin is put on the scales and weighed, then lifted on to the floor, and then immediately put on the scales again, the mere movement which this simple operation has involved will cause an abrasion such as will show a difference in weight. Bars, on the other hand, can be easily handled without much, if any, friction. When they arrive on the other side there is little loss in weight. In a big gold shipment this means much. The coin can be obtained without premium at the Sub-treasury on presentation of legal tenders, but coin is inferior to bars for export, because more easily abrased. The stamp of the United States on a coin is effective only within our own boundaries. As soon as the coin reaches a foreign country, its value is determined not by the stamp upon it but by its weight. So, when we are compelled to pay our debts by a gold shipment, the gold, whether it be bars or coin, is weighed and its value ascertained. Coin loses value by handling. Even new coin carried in bags loses value by abrasion during the trip across the Atlantic. It is stated at the Assay Office that if a bag of gold coin is put on the scales and weighed, then lifted on to the floor, and then immediately put on the scales again, the mere movement which this simple operation has involved will cause an abrasion such as will show a difference in weight. Bars, on the other hand, can be easily handled without much, if any, friction. When they arrive on the other side there is little loss in weight. In a big gold shipment this means much.

. . . . . .

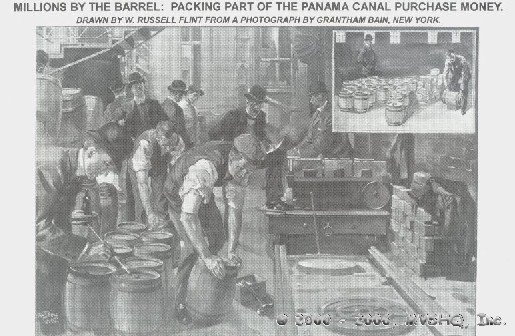

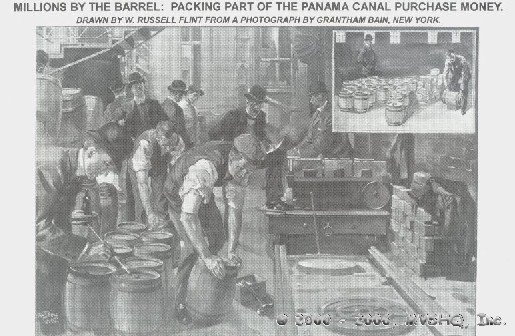

The shipper packs them in the rear court of the Assay Office in casks, with sawdust to prevent abrasion.

The Work of Wall Street, Sereno S. Pratt

D. Appleton and Co., New York and London, 1910, Pages 221-222, 236.

Assay Office Courtyard, 1904  The alleyway back of the assay office presented an unusual spectacle yesterday. It is in this alleyway that the gold bars are packed for shipment, and this operation has, of course, been carried on there many a time, but rarely, if ever, has there been so many bars packed at one time as has been the case Monday. The alleyway back of the assay office presented an unusual spectacle yesterday. It is in this alleyway that the gold bars are packed for shipment, and this operation has, of course, been carried on there many a time, but rarely, if ever, has there been so many bars packed at one time as has been the case Monday.

Two shippers packed at the same time, and fifty to sixty kegs were being filled with the bars at 1.30 o'clock. About $50,000 worth of gold was put into each keg. [Emphasis supplied.] The bars were packed in sawdust to prevent abrasion. Two shippers packed at the same time, and fifty to sixty kegs were being filled with the bars at 1.30 o'clock. About $50,000 worth of gold was put into each keg. [Emphasis supplied.] The bars were packed in sawdust to prevent abrasion.

Wall Street Journal, April 26, 1904, 8:2.  |  Before 1986, bars cast in this country [the United States] generally were rectangular bricks: 7 inches long, 3 5/8 inches wide, and between 1 5/8 inches and 1 3/4 inches thick. In recent years, however, gold bars cast in the United States, as well as most bars cast overseas, have been trapezoidal. |

... To qualify as good delivery in most international transactions, standard bars must be at least 99.5 percent pure gold and weigh between 350 and 430 troy ounces. Bars that meet that standard are called "fine" bars. ... A standard 400-troy ounce gold bar weighs 438.8 avoirdupois ounces, or 27.4 avoirdupois pounds. The Key to the Gold Vault, Public Information Department

The Federal Reserve Bank of New York, 1998, Pgs 12, 14. The banks and financial institutions were dependent on the availability of primarily gold bars at the New York Assay Office. Bankers preferred to ship bars because they were less expensive than coins. Coins were purchased at face value and were subject to wear and consequent, literal, gold loss before purchase. After purchase, coins were subject to additional gold loss through abrasion while in transit. Because of the normal "wear" of gold coins, their face value often exceeded their actual gold content value. On the other hand, gold bars were purchased on the sole basis of weight and fineness. If the New York Assay Office did not have sufficient bars for export, bankers would commit coins (preferably mint condition coins exhibiting minimum wear and, therefore, maximum weight) from the New York Sub-Treasury if the market purchase price was sufficient to cover, with profit, the expense of coins. Bars from the New York Assay Office were, therefore, the predominant form of gold export to Europe. ... When bars are shipped abroad, who stands the expense, the exporting bank or the Treasury? Why is gold coin not preferable?

The exporting banker stands all expenses of shipment, and in addition must pay the Treasury a premium of four hundred dollars for each million taken. The bars are packed in kegs, each of which holds about six bars worth eight thousand dollars apiece. [Emphasis supplied.] When bars are shipped, they are bought by weight and credited at the receiving bank in Europe by weight. But when coin is shipped, it has to be bought at the Treasury at face value. If the pieces are somewhat worn the exporting banker loses the difference, for the credit abroad is always by weight. For this reason bars are much more desirable [for export to Europe].

Harper's Weekly, February 6, 09, 30:3 ... Coin and Bars. The operation of shipping gold is in itself interesting. Coin is often used, but bar gold is preferable and used by shippers whenever it can be obtained at the U. S. ... [assay office]. Coin is paid for at its face value, but is credited abroad by weight. Unless it is new [our emphasis], therefore, considerable loss may be caused the shipper by reason of the fact of the coins having been rubbed and having lost weight. With bars, on the other hand, it is a mathematical calculation. So and so many ounces are bought at a certain price and paid for, and upon arrival of the metal on the other side are credited at so and so much per ounce. ... The Bankers Magazine, May - June 1910, 924:1 ... There is a practically unlimited supply of gold coin in the Sub-Treasury which will be paid out in exchange for gold certificates, but exchange must advance considerably before it will become profitable to export gold coin, on account of the risk of abrasion of the coin. When coin is exported it is valued according to its actual weight, while the Sub-Treasury pays it out at par [face value] as long as the abrasion is within the [legal] limit of tolerance. ... Wall Street Journal, December 14, 08, 8:5 ... The policy of the present administration of the Treasury Department appears to be to keep the mints employed coining gold bullion and not to accumulate a large stock of gold bars in the assay office, as was done under former administrations, and which facilitated gold exports. ... Wall Street Journal, December 4, 08, 8:1 ... The further decline of the Paris cheque on London to 25fr. 10c. has again advanced exchange here upon Paris to the gold export point, but there is little probability that any gold will go out until after the turn of the year. The demands of Paris upon New York for gold will be limited to the amount of gold bars that can be supplied by the Assay Office. The Bank of France does not care to import United States gold coin, and it is not the policy of the present administration of the Treasury Department of the United States to facilitate gold exports by transferring gold bars from other mints and assay offices to New York. ... Wall Street Journal, December 31, 08, 8:1 The Bank of France did not care to import United States gold coin. This detail will play an important part in our discussion of the Republic's cargos. |