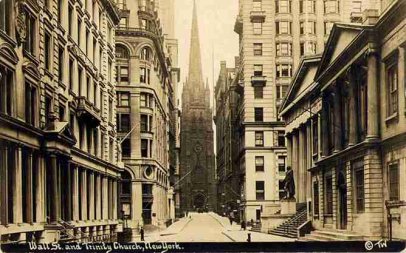

The New York Foreign Exchange MarketWall Street, circa 1910 An unorganized market is one where the offers to buy and offers to sell come together as a result of the natural working of self interest without the interposition or control of any organized body or authority. . . . The foreign exchange market is a good example of an unorganized market. There is no organized institution like the New York Stock Exchange where the offers to buy and the offers to sell foreign exchange are brought together. While there are foreign exchange brokers who are specialists in their field it is not incumbent on a purchaser or on a seller of foreign exchange to deal through a broker. Banks, brokers and individuals all do the best that they can for themselves either in buying or in selling foreign exchange, and it is this pursuit of self interest that establishes the tendency toward uniformity in prices, etc., that is characteristic of every real market. . . . All buyers are naturally seeking to purchase at the lowest possible prices, while all sellers desire to obtain the highest possible prices. 1 New York can claim the distinction of being the foreign exchange market of the country, because the great bulk of all foreign exchange transactions go through New York's market. 2 Exports and imports of gold from or to the United States growing out of foreign exchange transactions pass almost exclusively through New York. Such exports and imports, however, are everywhere recognized to have a significance for the country's banking position as a whole. Similarly, the protection of the country's reserves through influences exerted on the foreign exchange rates has to be undertaken in the New York market. 3 Wherever there is a demand for gold it is likely to be shifted upon the United States. Uncle Sam is 'easy' when it comes to supplying gold for the world. Instead of basing his own bank circulation on gold, he taxes himself and maintains a perpetual public debt so that he may have a basis for his bank currency. So when any nation wants gold it always knows where it may be had. Sometimes the benevolent old gentlemen may not have much gold in his treasury; but if not, he issues bonds and buys some with which to oblige the foreign friends who need it. Bankers Magazine, April, 09, 573 Comment Sub Treasury and Assay Office (left) And New York City was the major international commerce center. New York's financial newspapers - approximately twelve of them at that time - provide sufficient information to determine both the source and motive for individual gold transactions in the pre-World War I environment. Three newspapers were particularly useful. The New York Commercial, which circulated in the mornings, reported market and other financial activity of the previous day; The New York Evening Post reported the day's closing financial activity; and The Journal of Commerce, in its Monday editions, provided an itemization of exports for the previous week ending Saturday. Other financial newspapers that provide insight into the commercial transactions of the day include: The Wall Street Journal, The Commercial and Financial Chronicle, and The New York Times. Daily financial activity was also reported in the New York Evening Mail, Herald, Sun, Tribune and World. Boston, Philadelphia, London, and other New York papers have refined the background setting for the commercial transactions. A comprehensive study of these combined sources provides the following information:

... As is well known, gold moves along the line of exchange rates - that is to say, when exchange is high, gold is exported, and when exchange is low, gold is imported. For this, the reason is simple enough. Assume, for instance, that the rate of exchange on any given point is high. That in itself presupposes that the supply of exchange on that point is scarce. Anybody wishing to remit to that point, therefore, must either pay a high rate of exchange or must ship the only commodity which can figure in international payments - gold. When it happens that the cost of buying a draft for, say, one pound sterling, is greater than the cost of buying the equivalent of one pound sterling in gold, plus the charges of shipping that one pound sterling, then gold will go out. ... The Bankers Magazine, May - June 1910, 923-4 The information regarding gold engagements, which is contained in articles describing the daily gold market activity, identifies the institution (bank or securities firm) through whom the engagement was placed, the destination country, the amount and composition of the engagement (whether gold coin or bullion) and rate of exchange. The name of the institution initiating the transaction (the specific purchaser or consignee) was seldom reported. Cumulative totals of gold exports and engagements for specified periods are also provided ("The total of gold exports from Jan. 1 is $..."). Although, in their discussions of transactions, the newspapers frequently and inaccurately interchanged the terms "exported" (defined above), "engaged," "taken," "sent," and even "shipped," the cumulative reports, when used in conjunction with the U. S. Customs reports, enable a reconstruction of events and a clarification of each transaction. 2a. Engagement - Shipment Timing. When the transaction details and U. S. Customs export reports are sequentially compared, a pattern develops. The delivery and "export" of an engagement would generally occur sometime during the week following the engagement, with actual "shipment" occurring when the vessel departed its dock. Click for: January, 1909 Calendar. The following is an example of the typical delay between an engagement and actual shipment: This gold [engaged today, Monday] will be sent out on Friday next, with the other half million taken by the National City Bank last week. N. Y. Commercial, February 1, 09, 11:3 It was common for a shipment to occur sometime during the week following the engagement, and it was not uncommon for a shipment to occur as much as two weeks or more after the date of engagement. This delay was attributable to both the terms of delivery, and logistical planning. An importing bank may, for example, require gold for a particular future need. And the bank through whom the engagement was placed would have to order the gold from the Assay Office or Sub-Treasury [discussed next]. It would have to be accumulated (packed and/or counted). Determinations as to its routing, cargo space availability, insurance requirements, security, etc. would have to be made. The gold would then have to clear Customs and be loaded, and through each phase be checked and rechecked. This typical delay is also evident in the pattern of gold engagements which occurred in January, 1909 (Please examine this chart. It will be useful for your understanding.), with the notable exception, of course, of the January 12th, 1909, engagement.

U. S. ASSAY OFFICE. WALL ST. Built in 1823. 2b. Engagement Procedures. Although engagements were placed through one or more of a relatively small group of New York banking and other financial institutions who were "thoroughly familiar with the operation and who have the right facilities and connections abroad," the physical gold for export was derived directly from either the U.S. Government New York Assay Office (gold bars) or the U. S. Government's New York Sub-Treasury (gold coins). Engaged gold was delivered from either the New York Assay Office or Sub-Treasury vaults directly to the steamship company designated by either the engaging institution or the purchaser. BULLION The details of a gold shipment were carpartmentalized. The Sub Treasury or Assay Office would be paid by the purchasing institution, and directed to release the gold to a designated carting company, that day's equivalent to today's armored car service. Depending on the sequence of title, the carting company would be instructed by the original purchasing bank or by the importing banker, to deliver the gold to a designated steamship company at the steamship company's pier and/or bonded store. The steamship company would then load the gold from its pier and/or bonded store aboard an appropriate ship bound for the designated destination. The originating bank would know only that the gold was delivered to the carting company, the carting company would know only that the gold was delivered to a specified steamship company, and only the steamship company (and ultimate purchaser) would know the actual ship that was to carry the gold. The banks or financial institutions through whom the engagement was placed would seldom take actual physical possession of the gold in an export engagement.6 Aside from the custody of the trust funds of the Government, the subtreasuries perform a highly useful service to the public in making exchanges of money [redemption of gold and silver certificates], supplying money and coin where needed, and reducing the cost and expense of shipments of money and coin from a common center. It is necessary to maintain the facilities and conveniences provided by the subtreasuries in the large centers of business in the country, such as the cities in which the subtreasuries are now located. ... December 19, 1916, 64th Congress, | |

FOOTNOTES1Foreign Exchange and International Banking, The National City Bank Educational Series, 1919, Division II, Paper 2, pgs 3-4. | |

| |

| .. | |