The Threshold QuestionIn his book Men Under the Sea (Dodd, Mead & Company, New York, 1939, at pages 213 and 218-9), Commander Edward Ellsberg discusses the rumors of a gold shipment lost aboard the RMS Lusitania when that ship was torpedoed on May 7, 1915, during World War I. Did the Lusitania have any treasure aboard to dive for? Transatlantic liners do carry gold. … [However,] slight consideration will show the impossibility of any large amount aboard. Does the rumor of gold aboard RMS Republic at least satisfy this threshold question: was the direction of the "golden tide" eastbound, or westbound? Was gold being exported, or imported, when the RMS Republic departed New York on January 22, 1909? During January, 1909, gold was being exported from New York; gold was headed eastward, toward Europe, in the direction planned for RMS Republic. Gold Market and Export Activity - January, 1909.The chart "Gold Engagements - January 1909" (Please click for chart. A familiarity with the sequence of engagements is essential to the discussion.) indicates the day and date of specific gold engagements, the financial institution through whom the engagement was placed, the amount and composition (bars, if available from the Assay Office, otherwise coin from the Sub-Treasury), and the reported destination. The chart also correlates the engagement information with the U. S. Customs House "Reports of Exports" for the Port of New York.1 This correlation identifies the engagements exported each week. The slight difference between the total for engagements and that for exports in each week's correlation is attributable to the rounding off of engagements by the newspapers at the time that they were originally reported. The information for this chart was derived from both the New York Evening Post and the New York Commercial. The "Export Reports" in these two newspapers provided only information relating to the total of gold, but not composition, exported from the Port of New York. Information regarding the composition of the engagements was provided by articles describing market activity. All information is referenced by footnotes. The French Bank's Gold. THE FRENCH BANK'S GOLD A Paris View of the Recent Great PARIS, JANUARY 10 - The financial editor of the Paris Débats is thought to reflect opinion and sentiment at the Bank of France. N. Y. Evening Post, Jan. 23, 09, 8:1. Gold is at the Export Point, January 1909, STRENGTH OF FOREIGN EXCHANGE MARKET AT GOLD EXPORT POINT ALL WEEK

...

... Wall Street Journal, Jan. 18, 1909; 2:4 The Republic's Third TheoryTM Gold: GOLD EXPORTS STOPPED BANKERS EVEN GO TO PHILADELPHIA National City Bank Takes Last $500,000 International bankers are understood to have made efforts to secure gold bars from the Philadelphia mint yesterday when the supply of bars at the New York assay office was exhausted by the withdrawal of $500,000, for shipment to Paris tomorrow. The National City Bank made the engagement yesterday and although foreign exchange rates were at a level where gold could be shipped abroad with profit, the movement was checked again by the small supply of bars. ... While it would be expensive to transport gold bars from Philadelphia here, international bankers attempted to secure bars yesterday rather than ship gold coin. ... However, it is highly possible that in the event of the bankers being unable to secure a supply of bars at Philadelphia gold coin will be shipped as all the foreign bankers are in the market for gold. There has been much disapproval expressed against the small supply of gold bars at the assay office as on every occasion of gold exports last year the movement was stopped by this lack. Now there is scant doubt but that the bankers will ship gold coin, and it is expected that millions of the newly coined gold eagles [our emphasis] will be sent to foreign countries and be melted. The Bank of France alone may save the gold coin received, and ship it back at a later date when monetary conditions change... New York Commercial, January 12, 09, 14:5 MORE GOLD GOING.

The Globe and Commercial Advertiser, January 12, 1909, 12:3

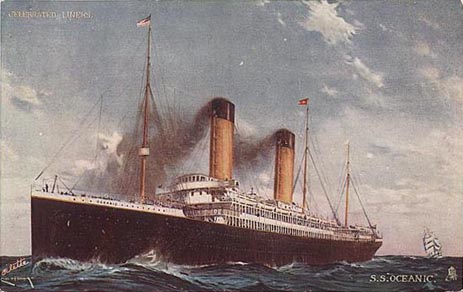

$3,500,000 GOLD FOR EUROPE To-morrow's Steamer to Be Treasure- Despite further large engagements of gold for export, sterling exchange rates continued very firm to-day, demand bills still hovering about 4.87 1/2, the highest level in more than a year. Announcements of engagements of gold for export to Paris continue, and to-morrow's steamer, the OCEANIC [the unlikely shipment aboard White Star Line's Oceanic will be discussed in detail later], will carry away altogether $3,500,000, mostly in coin. In addition to the $500,000 gold [bars] taken by the National City Bank early yesterday, $2,000,000 more was engaged by that institution, and another million by Goldman, Sachs & Co. This makes a total of $6,000,000 engaged since the middle of last week, and $12,100,000 since December 3, when the first shipment of the present movement was made. All of the $3,000,000 secured to-day for export was in the shape of coin, taken from the Sub-Treasury here. Efforts of bankers to secure bars from the Philadelphia Mint for shipment to Europe were unsuccessful, owing to the fact that the cost of transferring the money [gold certificates of deposit] for payment to Philadelphia, and bringing the bars to New York for shipment, would bring the total expense above that which would be entailed by the shipment of coin. New York Post, January 12, 09, 2:3

Christian Science Monitor (Boston, New York market to 2:40 p.m.) Gold engagements [for January 12, 1909] are reported of $2,000,000 by the City Bank, and $1,000,000 by Messrs. Goldman, Sachs, and Co., for Paris. The Times (London), Jan. 13, 09, 12:1 SHIP $3,000,000 IN GOLD COIN. Two Concerns Accept Money Because

New York Press, January 13, 1909, 8:6

New York American, January 13, 1909, 11:4 TO SHIP $3,500,000 GOLD. Metal Goes to Paris from National On the Oceanic to-day $3,500,000 in gold will go to the Bank of France, making a total since January 1 of $6,500,000 and $12,100,000 since December 3. The National City Bank sends to-day $2,500,000 of the total, and of this $520,000 is in gold bars, from the United States Assay Office. This metal is of high grade, all being more than .996 fine gold and some of it as high as .999. [Note: this quality of bar is consistent with "mint" bars for use in coinage, as opposed to assay office bars.] The minting operation kept the force busy Monday and yesterday and exhausted the bullion on hand. The remainder of the National City Bank's consignment will be in coin presumably from the Sub-Treasury although no request for it had been received up to a late hour yesterday afternoon. [Emphasis supplied.] Goldman, Sachs & Co. are sending $1,000,000 in coin, completing the $3,500,000 shipped to-day. As a reason for the Bank of France's zeal in accummulating the enormous quantity of gold it is said that Russia may engage much more than the $270,000,000 loan originally arranged for, in view of possible complications in the Balkans. Austria, too, it is pointed out, might want gold for emergency purposes of similar character. Sterling rates were firm yesterday, at about 4.87 1/2, the highest level for more than a year. N. Y. Herald, Jan. 13, 09, 16:1 TAKE MORE GOLD FOR PARIS Banks Will Ship $3,500,000 Today - Most Gold engagements aggregating $3,500,000, were announced yesterday for shipment to Paris today and indications pointed to a further outflow of the metal before the end of this week. The National City Bank added $2,000,000 to the $500,000 engaged on Monday, and Goldman, Sachs & Co. announced the engagement of $1,000,000. Only $500,000 of this total is in the shape of gold bars, the bankers being forced to ship gold coin, owing to the scarcity of bars suitable for export. ... ... The shipments today will almost all be in gold coin, a transaction that was not thought possible at any reasonable profit. New York Commercial, January 13, 09, 1:4 EBB OF GOLD STRENGTHENS. $3,500,000 Going Out To-day and Much Gold to the amount of $3,500,000 will be shipped to Paris to-day. Part of this is the $500,000 in bars secured by the National City Bank on Monday. The remainder is $2,000,000 coin taken yesterday by the [National] City Bank and $1,000,000 coin taken by Goldman, Sachs & Co. ... N. Y. Sun, January 13, 09, 3:6 GOLD EXPORTS - The National City Bank will ship $2,500,000 gold to Paris today, and Goldman, Sachs & Co., $1,000,000. Of this amount only $500,000 will be in gold bars. Sterling exchange rates were strong yesterday, the advance being due in great part to the continued selling of American securities for European account. ... N. Y. Tribune, January 13, 09, 13:1

New York World, January 13, 1909, 10:1. Gold Exports.

Boston Herald, January 13, 1909, 8:5. OUR GOLD TO AID RUSSIA. Importations by Bank of France Needed [Dispatch to the Associated Press](brackets in original) Paris, January 12 - The shipments of gold from New York are destined for the Bank of France, which has arranged for the engagements through Paris banking houses. The movement is a natural one, resulting from the favorable rate of exchange. The gold is probably for assisting in the flotation of the new Russian loan, which is announced for January 21 at 89 1/4. New York Post, January 13, 09, 1:6; One matter concerning which a good deal of curiosity was expressed to-day was the action of the Bank of France in offering to pay as high as 5 per cent. in this market for the use of money between January 22 and 25, the time covered in the bringing out of the new Russian loan. New York Sun, January 16, 1909, 10:2. ... It appears , according to Paris cable, that the Bank of France has thus far encouraged the movement [export of gold from New York] through arrangements the Bank has made with Paris banking houses. This statement indicates that these bankers have been enabled to offer inducements to their New York correspondents to ship the gold by making advances on the metal while it was in transit to Paris. If such, or other facilities, have been extended, that fact will go far to explain why the sale of bills incident to the export made so slight an impression on the market. If the movement of gold hence to Paris shall be solely on account of the Russian loan issue, it has been suggested that it will cease this week, for further exports cannot be made available before the subscription books for the loan shall be opened. [Emphasis supplied.] On the contrary, it is possible that consignees of the gold may be unwilling to forego the present opportunity for procuring the metal, under the existing favorable conditions, and they may attract additional sums, which will be employed for other purposes. ... The Commercial and Financial Chronicle, Jan. 16, 09, 123:1. The engagement of gold at New York on January 12, 1909, was, indeed, the last purchase of gold made by French bankers at New York (their next purchase took place on April 23, 1909), supporting the Chronicle's contention that the purchased gold was solely on account of the Russian loan issue. ... Though additional engagements of gold coin were effected on Tuesday [January 12, 1909], the market did not reflect offerings of bills incident to the intended shipment, and a strong tone continued to prevail. ... The Commercial and Financial Chronicle, Jan. 16, 09, 127:2.

National City Bank of New York, 55 Wall Street. The newspaper accounts report that a $3,000,000 engagement occurred on January 12, 1909, and that this gold was to be applied to the imminent Russian Loan which was scheduled to close just 9 days later, January 21, 1909. Paris banking houses, ostensibly shipping their gold to their depository, the Bank of France, secured this engagement through National City Bank, today's Citibank, ($2,000,000) and Goldman, Sachs & Company ($1,000,000). Unfortunately for the banks, the New York Assay Office had just recently exhausted its supply of gold bars, and, therefore, this engagement was placed with the Sub-Treasury; a $3,000,000 face value in gold pieces comprised entirely of newly minted American Gold Eagles. It must be noted that a differentiation in coin-engagement descriptions was made at the time. For example, a Journal of Commerce article of January 28, 09, 3:4, describes a slightly later engagement to Argentina as follows: Yesterday there was withdrawn from the Sub-Treasury $1,000,000 in gold coin for shipment to Argentina. One lot of $500,000, taken by Goldman, Sachs & Company, was in eagles, and the other $500,000, which is being shipped by Muller, Schall & Company, in mixed gold. A $500,000 engagement in "eagles" would be comprised of $5,000 bags, each containing equal denomination coin, purchased at face value. $500,000 in "mixed gold" coin refers to a shipment comprised of 500 troy ounce bags of mixed denomination purchased by weight.2 The January 12th engagement is unique; it is the only $3,000,000 coin engagement, and the only $3,000,000 engagement comprised entirely of newly minted American Gold Eagles, which occurred at any time during the ten year period 1904 through 1913 (one occurred in 1914) and it also complies to the specifications of the legendary gold lost aboard the REPUBLIC. If we were to place it aboard the REPUBLIC, this $3,000,000 American Gold Eagle engagement would also fall within the typical time delay parameters between engagement and shipment. Why would this shipment be placed aboard Republic? We discuss that next ... | |

FOOTNOTES1Information derived from the Saturday editions of the New York Post. The more detailed export reports appeared in the Monday editions of the Journal of Commerce and are used later in this report. | |

| .. | |